Experian Plans To Sell More Of Your Data

If you’re in the US and have a Social Security Number, congratulations - Experian, the multinational consumer credit reporting and data aggregator company, is planning to sell off more of your data to third-parties starting February 5, 2025.

This past Saturday, shortly after midnight, they sent this note to its customers:

Important updates to Experian Consumer Services’ information practices: The Experian Consumer Services terms of use and privacy policy have been updated to reflect some changes to our information practices and to give you the opportunity to opt out of certain information sharing. Starting 2/5/25, we may disclose information about our subscribers’ transactions and experiences with us to our affiliates and non-affiliated companies, including for their marketing purposes.

Great! I am sure people will have no qualms with a company that had been breached in 2015 (15 million people’s personal information exposed), 2020 (impacting 24 million South Africans), 2021 (impacting 220 million Brazillians), and 2022 (who knows how many people were impacted by that) taking more of their data and shoveling it to third-parties that should never have access to this information to begin with.

And should we expect something better from a company that has been described by Senator Ron Wyden like this in 2023?

The credit bureaus are poorly regulated, act as if they are above the law and have thumbed their noses at Congressional oversight. Just last year, Experian ignored repeated briefing requests from my office after you revealed another cybersecurity lapse the company.

But good news - you can opt-out! To do that, you can click that big purple button in the email you received:

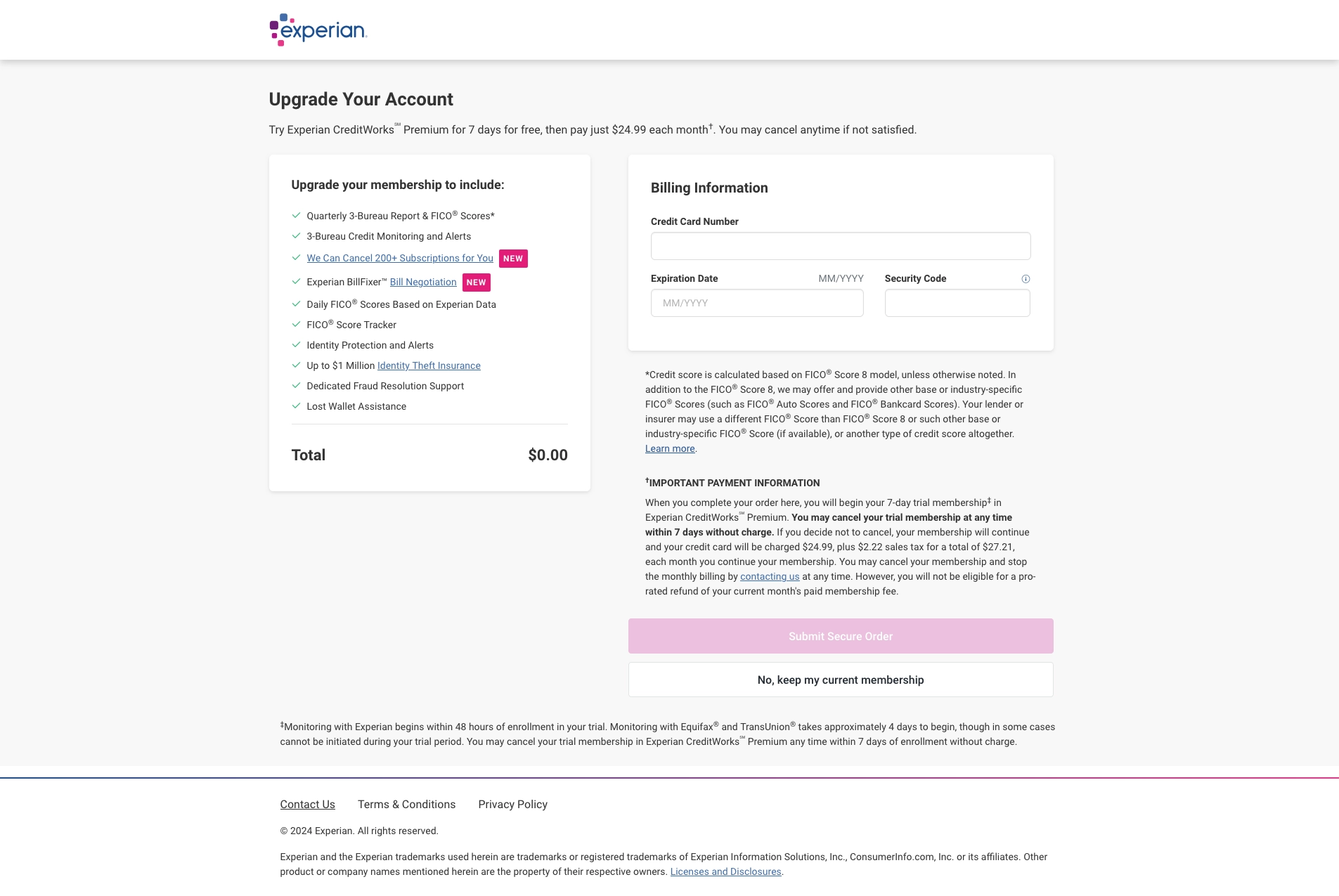

Which then promptly greets you with an upsell opportunity, because why not - not only are you and your data the product, but how about you also pay for the privilege of being notified next time your data is sold somewhere 🤷

Also, great way to integrate a dark pattern - show in big, bold font that the total is $0.00, tricking people into thinking they are getting something for free, only to charge $24.99/mo after seven days. The fact that even the direct opt-out link doesn’t take you to the opt-out page and instead takes this as an opportunity to get more cash from a customer tells you everything you need to know about the ethics of this affair.

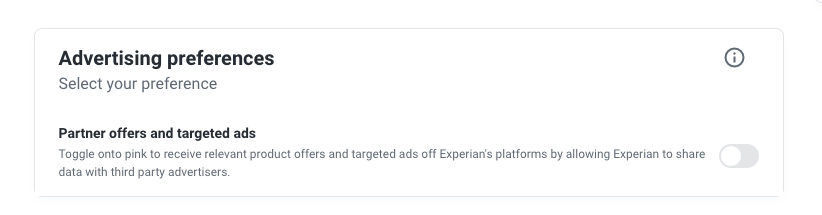

But once you’re past this nagging screen, you can select the slider on your account page that (theoretically) limits Experian’s capabilities on sharing your data with third-parties that should not be getting your data.

Now, it might be moot to say this because we’re talking about credit bureaus that collect and disseminate your data anyway, but as a general guidance to help preserve more of your own privacy (there are more things you can do, but that’s its own blog post), try following these tips:

- Do everything you can to limit the sharing of your personal information. If a company/site/organization doesn’t need to know something about you, do not give it to them.

- Use the provided opt-outs, both in cases of credit bureaus and any other companies you might be a customer of. For example, did you know you can opt out of pre-screened credit card offers?

- Use a Pi-hole to limit marketing profiling on you and your family at the DNS level. Couple that with a privacy-preserving browser with an ad-blocking extension such as uBlock Origin to limit what ads are shown and what data is collected from your devices (applicable to both on desktop and mobile environments).